Monthly depreciation calculator

United States Salary Tax Calculator 202223. Use our amortization schedule calculator to estimate your monthly loan repayments interest rate and payoff date on a mortgage or other type of loan.

How Can I Make A Depreciation Schedule In Excel

30000 as depreciation in this case next year wdv will be.

. Use this depreciation calculator to forecast the value loss for a new or used car. But for the next year your wdv will be considered as reduced by the percentage of depreciation prescribed. TaxAdda Private Limited CIN - U93000RJ2019PTC067547 GSTIN - 08AAHCT6764E1Z1.

To help you see current market conditions and find a local lender current Redmond truck loan rates are published in a table below the calculator. Depreciation to be charged from Year 2 onwards is Rs350000. Edmunds True Cost to Own TCO takes depreciation.

Assets are depreciated for their entire life allowing printing of past current and. In this way we can conclude that with the revision in estimates of the useful life of assets and Residual Value the Depreciation amount also gets revised keeping the amount to be charged as depreciation constant every year. Each repayment for an amortized loan will contain both an interest payment and payment towards the principal balance which varies for each pay period.

The appliance depreciation calculator estimates the actual cash value of any home appliances that you own. In the early 2000s the most common auto loan term in the US was for five years or 60 months. The monthly interest rate payment calculator exactly as you see it above is 100 free for you to use.

The second tab provides a calculator which helps you see how much vehicle you can afford based upon a fixed monthly budget and desired loan term. It starts with the large drop in value after the first year then levels out to a lower depreciation rate in the following years. When you begin budgeting yourself for a mortgage dont over-stretch yourself.

Car B has a 36-month lease with monthly payments of 185 and 3000 down. TrueCars lease calculator can help you determine which combination of these factors will make the most sense for you as you decide on an auto lease. Monthly depreciation monthly interest amount monthly tax amount monthly lease payment.

By entering a few details such as price vehicle age and usage and time of your ownership we use our. Final value residual value - The expected final market value after the useful life of the asset. Asset value - The original value of the asset for which you are calculating depreciation.

The appreciation calculator is a tool that helps you find the future value of anything. The difference between the loan amount and the residual value is the amount of depreciation you are financing. We follow a 40-year investment strategy that increases the monthly cash flow for rental income through tax depreciation schedules accepted by the ATO.

With this calculator you can also compare the loan repayments over different periods of time and opt for the most affordable option. It may be home appreciation investments or anything else you need but first you need to know how to calculate appreciation and what it isRemember that if the value of your product decreases over time you may use the depreciation calculator or use a negative appreciation rate. Depreciation Calculator as per Companies Act 2013.

As a good rule of thumb repairs tend to run close to 100 or so per month on average though it can vary significantly based on the vehicles age and. The early loan repayment calculator will help you to calculate the monthly interest repayments and compare how alterations to the loan payments can reduce the overall cost of the loan. Water Intake Calculator new.

Below is the explanation of the values that are required to add to the calculator for calculation. Our Early Repayment Loan Calculator provides you with a variety of monthly interest periods such as 1 year 2 years 3 years 4 years 5 years and 10 years as well as the ability to compare them on the monthly repayment basis that you choose. The calculator allows you to use Straight Line Method Declining Balance Method Sum of the Years Digits Method and Reducing Balance Method to calculate.

Each calculation done by the calculator will also come with an annual and monthly amortization schedule above. The most accurate way to calculate the cost of depreciation for a fleet is by using the accelerated method. DepPro Depreciation Professionals property report investment property calculator investing in property tax depreciation property depreciation Melbourne.

To calculate the impact of depreciation compare an example for a commercial truck worth 100000. Loan interest taxes fees fuel maintenance and repairs into. Salary Income Tax Calculators.

Im also going to add in my depreciation costs here of 448 a month based on our depreciation example above. The following article will explain the. Whether you are thinking about replacing your old appliances like a washing machine or dealing with a home insurance policy that offers replacement cash value or actual cash value this calculator has got you covered.

Car Depreciation Calculator new. Car A has a 36-month lease with monthly payments of 200 and 1500 down. Depreciation for Year 2 Rs350000.

However 72-month auto loans have recently become a more. A lot of people who lease new cars focus only on the monthly payment and dont take the total cost into account. Mortgage Payment Holiday Calculator Calculate the new remaining balance and adjusted monthly payments if you take a payment holiday from your mortgage.

For eg if an asset is of Rs. 22222 7980 2190 32392. But since this field is a weekly field Im going to divide 448 by 433 433 is the number of weeks in an average month so that comes to about 103 a week in depreciation expenses.

Say youre looking at two lease deals on similar cars. Period - The estimated useful life span or life expectancy of an asset. For more information about or to do calculations involving depreciation please.

Star Software Fixed Asset Depreciation provides for Book Tax Alternate ACE and Other State depreciation. MACRS ACRS 150 200 Declining Balance Straight-Line Sum-of-the-Years-Digits Vehicles Amortization Units of Production and Non-Depreciating asset methods are all available. United States Minimum Wage Calculator.

This calculator figures monthly truck loan payments. What will my monthly car payment be if I take out a 72-month six year loan. Calculate the cost of owning a car new or used vehicle over the next 5 years.

Depreciation can be claimed at lower rate as per income tax act. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999. 1 lakh and 80 depreciation is prescribed for the asset and you charge only rs.

While this calculator allows people to estimate the cost of interest and depreciation other costs of vehicle ownership like licensing fueling repairs automotive insurance are not included. This calculator displays your monthly payment and a full schedule of your upcoming principal and interest payments. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods.

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

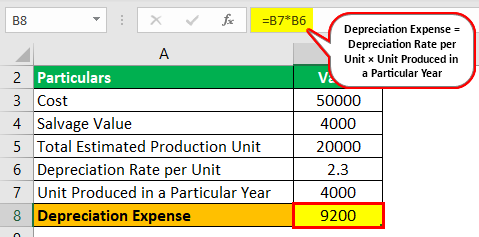

Unit Of Production Depreciation Method Formula Examples

Depreciation Formula Examples With Excel Template

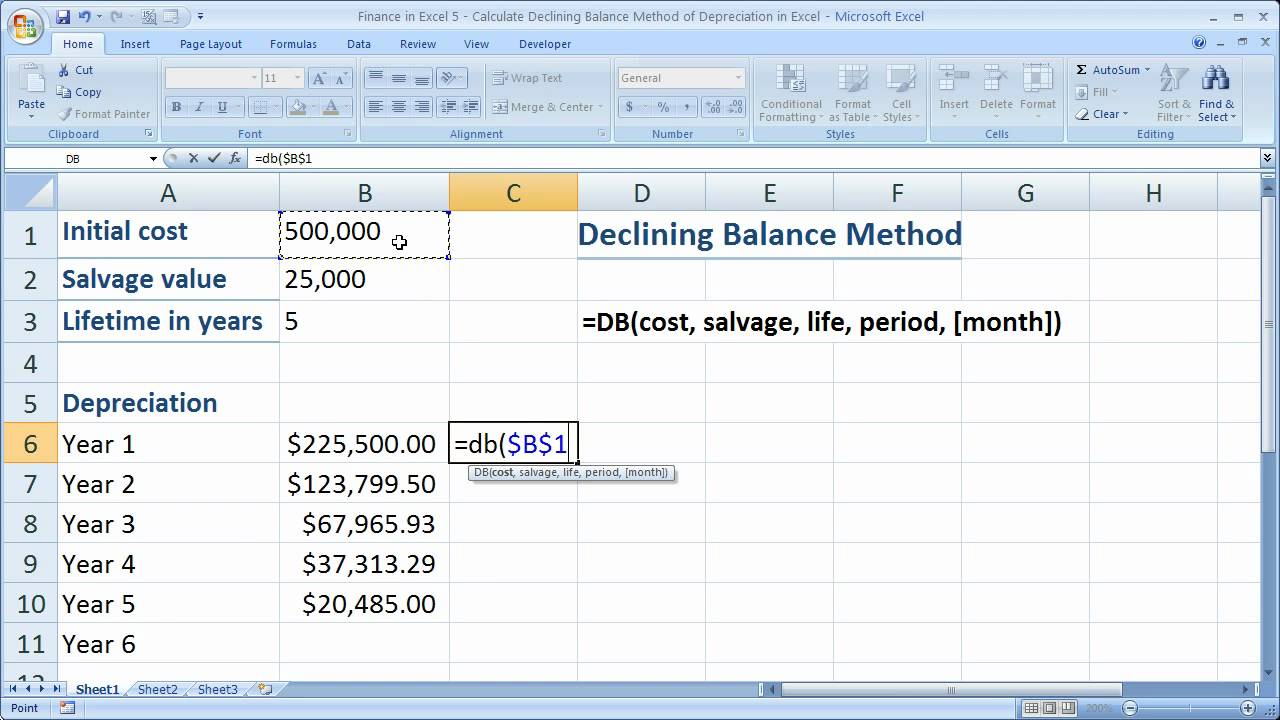

Finance In Excel 5 Calculate Declining Balance Method Of Depreciation In Excel Youtube

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

How To Use The Excel Amorlinc Function Exceljet

Depreciation Expense Double Entry Bookkeeping

Depreciation Rate Formula Examples How To Calculate

Declining Balance Depreciation Calculator

Depreciation Calculator Store 60 Off Www Wtashows Com

Depreciation Formula Examples With Excel Template

Unit Of Production Depreciation Method Formula Examples

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping

Straight Line Depreciation Tables Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Free Macrs Depreciation Calculator For Excel